About us

Welcome to Motor Matcher! A faster, simpler way to compare, buy and sell cars online.

Looking for the best car insurance provider in Australia? Before selecting the best car insurance provider for your car, it is important to consider and focus on a few key areas. From what your comprehensive cover includes - to the policy details and customer service - not all insurance providers are equal. And what about the price? That’s only half the battle!

This article aims to guide you in the right direction and help you to choose the right car insurance. Whilst it’s a task that seems so obscure now - it might just be crucial in the long run. As you walk through this blog, you will get an end-to-end understanding of the steps you need to take to select the best insurance provider for your car.

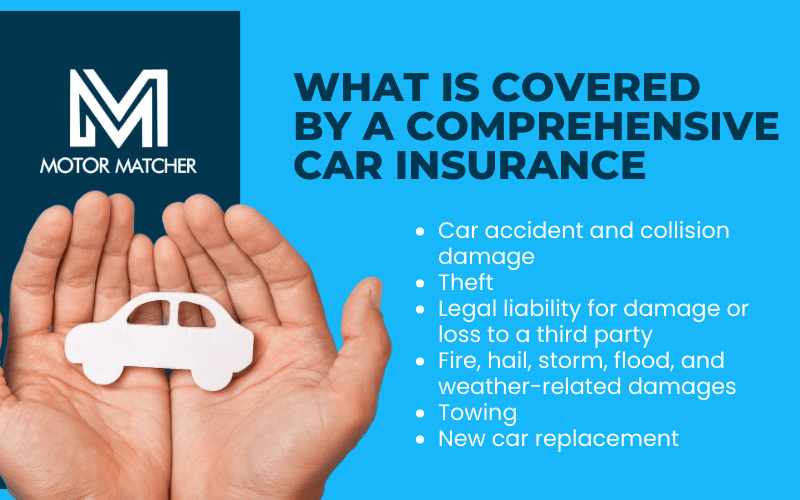

A comprehensive automobile insurance policy in Australia gives the most complete level of coverage available. Damage to your vehicle and the property of other drivers can be covered by this policy.

Damage to your car that is a result of fire, storm, and hail, as well as the cost of a new vehicle if yours is stolen, are all covered under this policy. Regardless of who is responsible for the damage, comprehensive coverage will cover the cost of repairs.

Your coverage may also include benefits like windshield replacement and a complimentary rental car while your vehicle is being fixed.

In the event of an accident, theft, or fire, your vehicle is covered. It also provides emergency lodging and transportation as part of the package.

The following are typical inclusions from having comprehensive auto insurance:

Multiple factors can affect the average cost of comprehensive car insurance, and your insurer will use these to figure out how much you'll pay. Factors that might come into play when fees are being calculated. A few include your vehicle, your age, your location, how much you drive, your previous claims history and the location of where you park the vehicle.

Your driving record might have a big influence on the cost of your coverage. Most insurers provide coverage based on life phases. Younger drivers might expect to pay higher rates due to their higher risk of road accidents.

Your driving record also affects your premium. This includes low kilometer drivers (retirees or those who utilise public transportation), business drivers, and “safe drivers” (people who haven't filed an at-fault claim against their coverage for a specified period).

The cost of comprehensive insurance varies based on the automobile you drive. Your premium will certainly rise if you own a car with powerful engines or is considered to be vintage. In general, if it's costly to replace, it's costly to insure.

Your postcode and address affect premium costs. Insurance companies also consider whether your automobile is secured (in a garage or off-street carport) or not.

In the case of an at-fault claim, you must pay an excess. Generally, the more you pay in excess, the cheaper your premium. The insurer or repairer pays this extra.

This is the best time to think about other fees like registration, service, and insurance when determining what automobile you can afford.

Even if someone else is to blame, you should think about getting insurance to cover unforeseen events.

Whether or not you've made a decision yet, it does pay off to do your research and have a holistic understanding of what you will get to find the best comprehensive car insurer to meet your needs.

Everything we do at MotorMatcher is based on the idea of giving our customers the information they need to make an informed decision regarding buying and selling a car. With our ‘new and used’ vehicle comparison tool, we've created a convenient online marketplace for both buyers and sellers of automobiles that's both quick and secure.