About us

Welcome to Motor Matcher! A faster, simpler way to compare, buy and sell cars online.

Filling out your tax return? Don't forget about your car! If you use your wheels for business at all, you are eligible to claim some serious tax deductions on those expenses. Who doesn't love racking up tax deductions for more savings, right?

So, let's make sure you'll get the most of it with our expert-recommended tips on knowing and calculating how much you can save from your taxes.

Buckle up and get ready to explore the top car expenses you can claim as tax deductions in this blog!

Tax deductions for car expenses are something not new in the Australian landscape. It's often done to help drivers and businesses using vehicles to save up and avail of the deductibles during the tax season.

A little disclaimer though, these tax deductions only apply for vehicles used for business purposes. But if your car is being driven for both personal and business use, we'll have a separate conversation about that later.

So how can these tax deductions for car expenses help you?

When you use your car for business purposes, it's essentially an extra work expense. The deduction helps offset the financial burden of running a vehicle specifically for work.

By offering tax relief for car expenses, the government aims to incentivise people to travel for work and conduct business-related activities. This can be especially helpful for sole traders, salespeople, or those who travel regionally for work.

Owning and maintaining a car comes with inherent costs, regardless of how it's used. Since business use adds extra wear and tear, deductions acknowledge this and offer some tax relief.

However, it's important to remember that deductions are only allowed for the business portion of car expenses. The idea is to create a fair system where personal car use isn't subsidised by tax breaks.

Separating your car's business and personal usage when filing for tax deductions in Australia is crucial for a few reasons.

The Australian Taxation Office (ATO) only allows deductions for work-related expenses. Since your car likely isn't used solely for business, claiming the entire cost wouldn't be accurate, and faithful. Separating usage ensures you're only claiming the tax relief you're entitled to for the business portion.

Inaccurate deductions can raise red flags with the ATO and potentially lead to a thorough audit. By meticulously tracking business and personal use, you can accurately claim deductions and avoid any unnecessary scrutiny.

Depending on the method you choose, separating usage can help you maximise your deductions. For example, the logbook method allows claiming a wider range of expenses based on the actual business use percentage.

Keeping clear records of business and personal kilometres simplifies the tax filing process. It saves you time and effort when calculating deductions and avoids any confusion come tax time.

Here's an analogy to better explain. Imagine your car is a shared office space – part for work and part for personal use. Separating usage is like claiming rent only for the business portion of the space you occupy, which is fair and accurate.

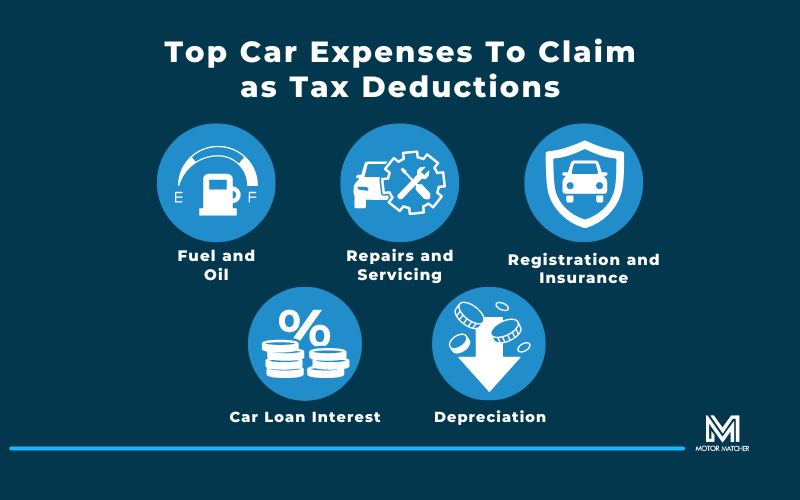

As you're equipped with the hows and whys of tax deductions for vehicles, you're now ready to know what expenses can qualify for your tax deduction claims. And here are all of them.

Cars naturally lose value over time. The ATO allows you to claim this depreciation as a tax deduction, typically calculated at 25% using the diminishing value method.

Depending on your specific circumstances, you might also be able to claim:

There are two main methods for calculating your tax deduction claims for a car's business usage in Australia–the cents per kilometre method and the logbook method.

This is a straightforward approach with a set rate per business kilometre travelled. The ATO sets the rate annually, with 2024 rate at 85 cents per km.

To calculate, multiply the business kilometres driven in the tax year by the current cents per kilometre rate.

Example:

The more detailed computation option, this method allows you to potentially claim a higher deduction by calculating the business percentage of total car expenses.

The best method for computing car expenses for tax deductions will ultimately depend on your driving habits and how much detail you're comfortable managing. But here's a quick way to decide what to use.

Want to know more about tax deductions? The secret to getting the most of these tax deductibles isn't only on your computation, but on the car you're using.

Whether you need a fuel-efficient car to rack up those business kilometres or a reliable workhorse, Motor Matcher can help! Search our extensive listings of new and used cars to find the perfect fit for your needs and budget. Plus, with our user-friendly platform, selling your current car is easy – freeing up some cash for that upgrade or unexpected tax return windfall!

So, browse them all at Motor Matcher today and get ready to rev up your tax return and your ride!